Client Profile: Anuj

👨 Anuj, 28-year-old software engineer, first-time investor

🎯 Goal: To start investing ₹5,000/month safely for long-term wealth creation

The Challenge

“I’ve heard a lot about SIPs. But is it really safe? What if the market crashes? Will I lose all my money?”

Instead of simply answering yes or no, we took Anuj through a case-based explanation—using a real mutual fund to illustrate.

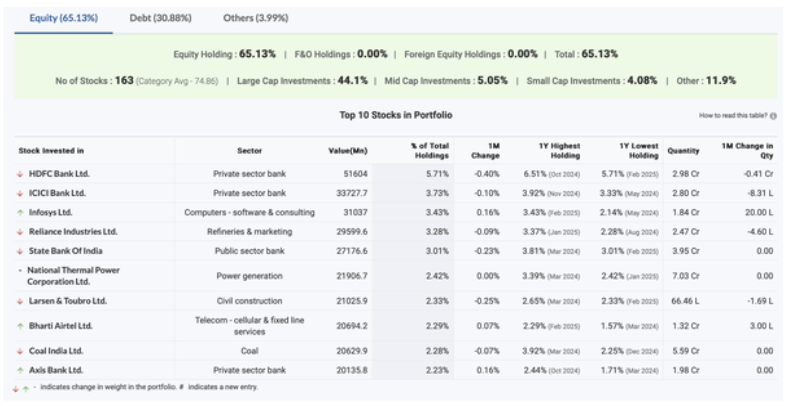

Fund Breakdown – HDFC Balanced Advantage Fund

These aren’t random stocks. These are professionally curated, well-governed businesses.

1. You’re Investing in Real Companies

HDFC Balanced Advantage Fund (like many hybrid funds) invests across:

- Large, well-established companies

- Multiple sectors – banking, IT, pharma, FMCG

These aren’t random stocks. These are professionally curated, well-governed businesses.

Takeaway: You’re not gambling. You’re co-investing in India’s leading companies.

2. Sector Diversification = Reduced Risk

If pharma underperforms, banking might compensate. Sector diversification protects you.

Takeaway: Unless the entire economy collapses, you’re shielded against isolated risks.

3. Fund Managers = Portfolio Caretakers

Professionally managed by experts whose job is to:

- Monitor performance

- Rebalance portfolios

- Beat benchmark returns

Takeaway: You don’t need to track the market daily—experts are doing it for you.

4. Regulated by SEBI

Mutual funds are tightly regulated by SEBI. AMCs can’t misuse investor money or shut shop.

Takeaway: Your money is in a system backed by rules—not a shady scheme.

The SIP Advantage – Rupee Cost Averaging

Instead of timing the market, a SIP buys more units when prices are low, and fewer when high—automatically averaging out the cost.

Takeaway: SIPs build discipline and reduce volatility—even in market dips.

Bonus: Power of Compounding

- ₹5,000/month SIP for 20 years

- Expected return: ~12% CAGR

- Corpus: ₹50+ lakhs

Takeaway: Time + consistency lets compounding do the heavy lifting.

Final Learning: SIPs = Safety, Scale, Sanity

- SIPs aren’t speculative

- Risk is managed through diversification & professionals

- Time + discipline = long-term wealth

Anuj started a ₹5,000/month SIP in a balanced fund and now reviews it every 6 months.

Outcome

- Grew his corpus steadily without panic during market dips

- Added a second SIP in ELSS for tax savings

- Gained confidence to build a long-term financial roadmap