Client Profile:

👤 Mr. Gupta, 60 years old, recently retired senior executive

💼 Corpus: ₹2.5 Crore from retirement benefits & savings

🎯 Goal: Generate ₹1 lakh/month income for 20 years, while keeping capital safe

The Retirement Income Challenge

Mr. Gupta reached out to Team Saan with a concern that many retirees share:

“How do I get a reliable monthly income without depleting my entire savings? I want something better than an FD but without high risk.”

The Solution: Systematic Withdrawal Plan (SWP) in Mutual Funds

We suggested an SWP strategy — a smart way to:

- Generate consistent monthly cash flow

- Beat inflation

- Grow your corpus over time

- Avoid the low returns & tax inefficiencies of FDs

The SWP Plan: How It Worked

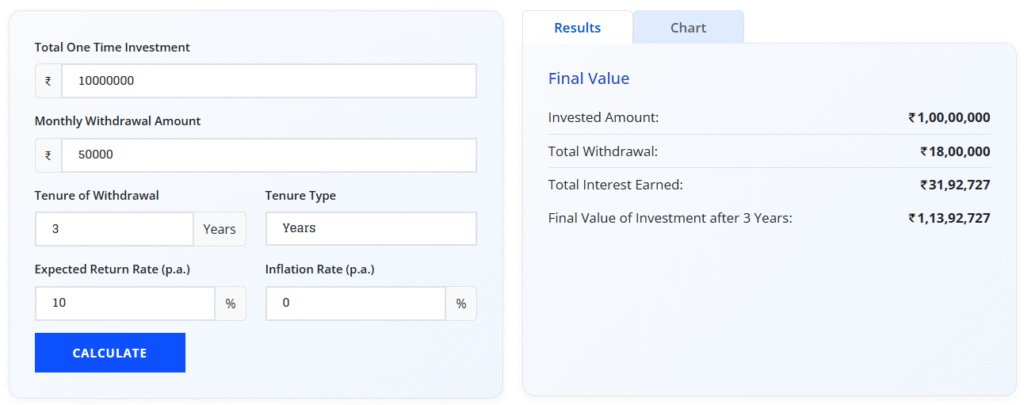

We structured the ₹2.5 Cr corpus in a diversified hybrid mutual fund, assuming:

- Annual return: ~12%

- Withdrawal: ₹1,00,000/month

- Duration: 20 years

Result:

- Mr. Gupta received ₹1 lakh every month without fail

- At the end of 20 years, his corpus still grew to ₹3.65 Cr, even after withdrawals

- Adjusted for inflation, his real purchasing power was preserved

Stable income + Capital growth + Inflation hedge = Financial peace of mind

Why SWP Worked for Mr. Gupta

- Capital Efficiency:

Unlike fixed deposits, the capital wasn’t locked at 7%–8%. It was invested for growth and flexibility. - Tax Advantage:

Long-term capital gains (after 3 years) from debt/equity hybrid funds are more tax-efficient than interest income from FDs. - Liquidity & Control:

He could modify or pause withdrawals at any time — unlike annuity or pension products. - Emotional Comfort:

The idea of growing his corpus while living off it gave him confidence and freedom.

Final Learning: Retirement Doesn’t Mean Stagnation

Mr. Gupta’s story proves that with the right planning:

- You can live well in retirement

- Beat inflation without taking unnecessary risks

- Grow your capital while using it